Overview

DataPoints helps financial advisors understand clients' money mindsets. Its range of behavioral assessments helps uncover clients' attitudes toward money, risk tolerance, money beliefs, and skills for wealth building. The integration with Wealthbox enables advisors to import assessment results—such as financial personality, attitudes, and risk tolerance—from DataPoints directly into Wealthbox.

🔗 Click Here to Watch Automating Wealth-Building Strategies with DataPoints + Wealthbox

Key Features

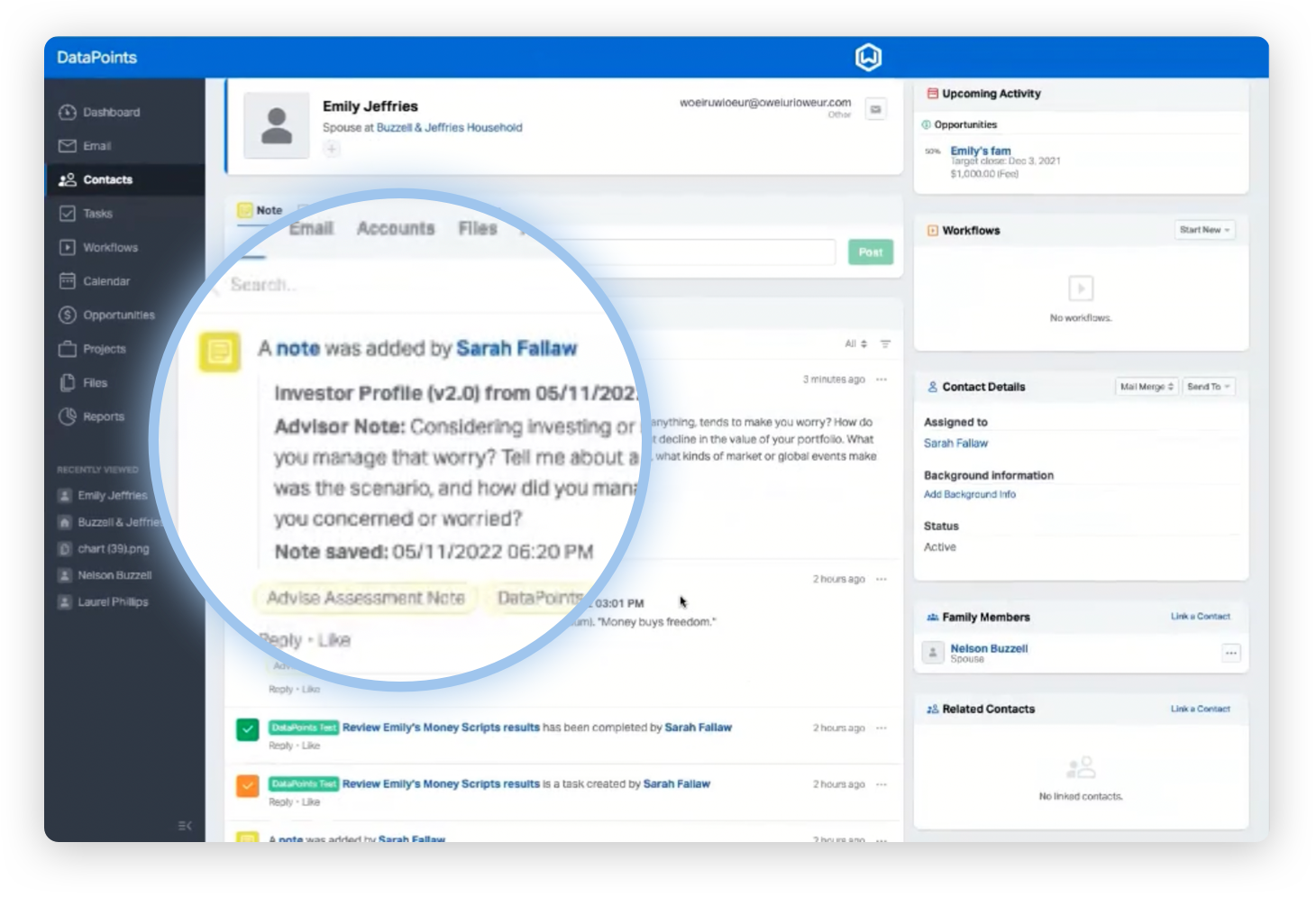

- Advisor Report Notes Sync: Notes you take on advisor reports within DataPoints are automatically sent to Wealthbox as CRM notes, helping you keep all client insights and observations organized in one place.

-

Assessment Results in Wealthbox: Automatically import clients’ financial personality profiles, attitudes, and risk tolerance scores from DataPoints into Wealthbox, where they appear as notes on contact records.

-

Flexible Contact Import and Export: Easily import contacts from Wealthbox into DataPoints to assign assessments or track progress, and send new leads and contacts collected in DataPoints back into Wealthbox.

Comprehensive Activity Feed: View behavioral assessments, test scores, and investor profiles right in your Wealthbox activity feed for a complete picture of each client’s mindset and financial behaviors.

Test Score Logging: Results from any assessment in the DataPoints library are sent automatically as notes in Wealthbox, making it simple to keep records up to date.

How Does the DataPoints Integration Work

This process involves obtaining detailed notes on clients' attitudes towards managing client money, their personality traits, and the results of their psychological risk tolerance assessments. These notes help in better understanding the clients' financial behaviors and preferences. Additionally, the integration system automatically transfers new leads collected from DataPoints Engage assessments directly into the Wealthbox CRM as new contact entries. This seamless data flow ensures that the sales and client management teams have immediate access to up-to-date client information, facilitating more personalized and efficient engagement with prospects and existing clients.

How to Enable the DataPoints Integration

The integration is enabled on the DataPoints side—please reach out to their team directly if you need any assistance getting started.

Troubleshooting & FAQs

Q: How do I enable the integration between DataPoints and Wealthbox?

A: The integration is activated directly within DataPoints. To get started, please contact the DataPoints support team for help with setup and configuration.

Q: What information does DataPoints sync into Wealthbox?

A: DataPoints automatically sends financial personality profiles, attitudes toward money, risk tolerance scores, and test results to Wealthbox. These details appear as notes in your contacts’ records, so you can access them at a glance.

Q: Can I send leads or contacts from DataPoints back into Wealthbox?

A: Yes, new leads generated through DataPoints Engage assessments can be sent directly into Wealthbox as new contacts, streamlining your workflow and keeping your CRM up to date.