Overview

This article outlines the Andes Wealth integration, how it functions, how to set it up, and how to troubleshoot common problems. It also features an FAQ section that addresses common questions and offers additional guidance.

🔗 Click Here to Watch How Advisors Use Wealthbox + Andes for Enhanced Client Servicing

What is Andes Wealth?

The Andes Wealth Technologies integration allows advisors to synchronize client information between Wealthbox and Andes, enabling users to access and manage data across both platforms. The integration streamlines workflows and enhances efficiency for financial advisors, ensuring a cohesive experience for managing client relationships and investments.

How does the Andes Wealth Integration Work?

-

Easily synchronize contact information between Wealthbox and Andes Wealth Technologies to ensure consistent and up-to-date client records.

-

Data from Wealthbox syncs to the Andes platform automatically each night, reducing manual work and keeping information current.

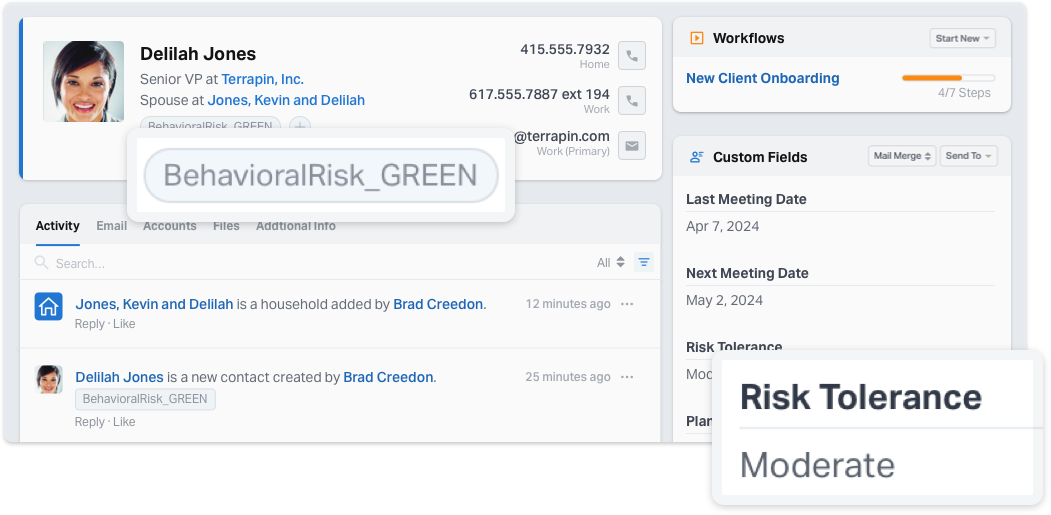

- When advisors conduct risk and behavioral profiling assessments in Andes, the results are automatically pushed to Wealthbox—ensuring insights are readily available within the client’s CRM record.

How to Enable the Integration

-

In the Andes Wealth Platform, select "Integration" and then click “Integration setup.”

-

Choose Wealthbox from the options.

-

Click the "Connect" button.

-

Enter your Wealthbox login credentials to connect your Wealthbox account to the Andes Wealth Platform.

-

Complete! You can manually sync data now, or it will be synced in the nightly batch job.

→ All information from Wealthbox will transfer to the Andes Platform.

Look for a green checkmark in the Wealthbox column on the Household page, indicating that the households are integrated from Wealthbox.